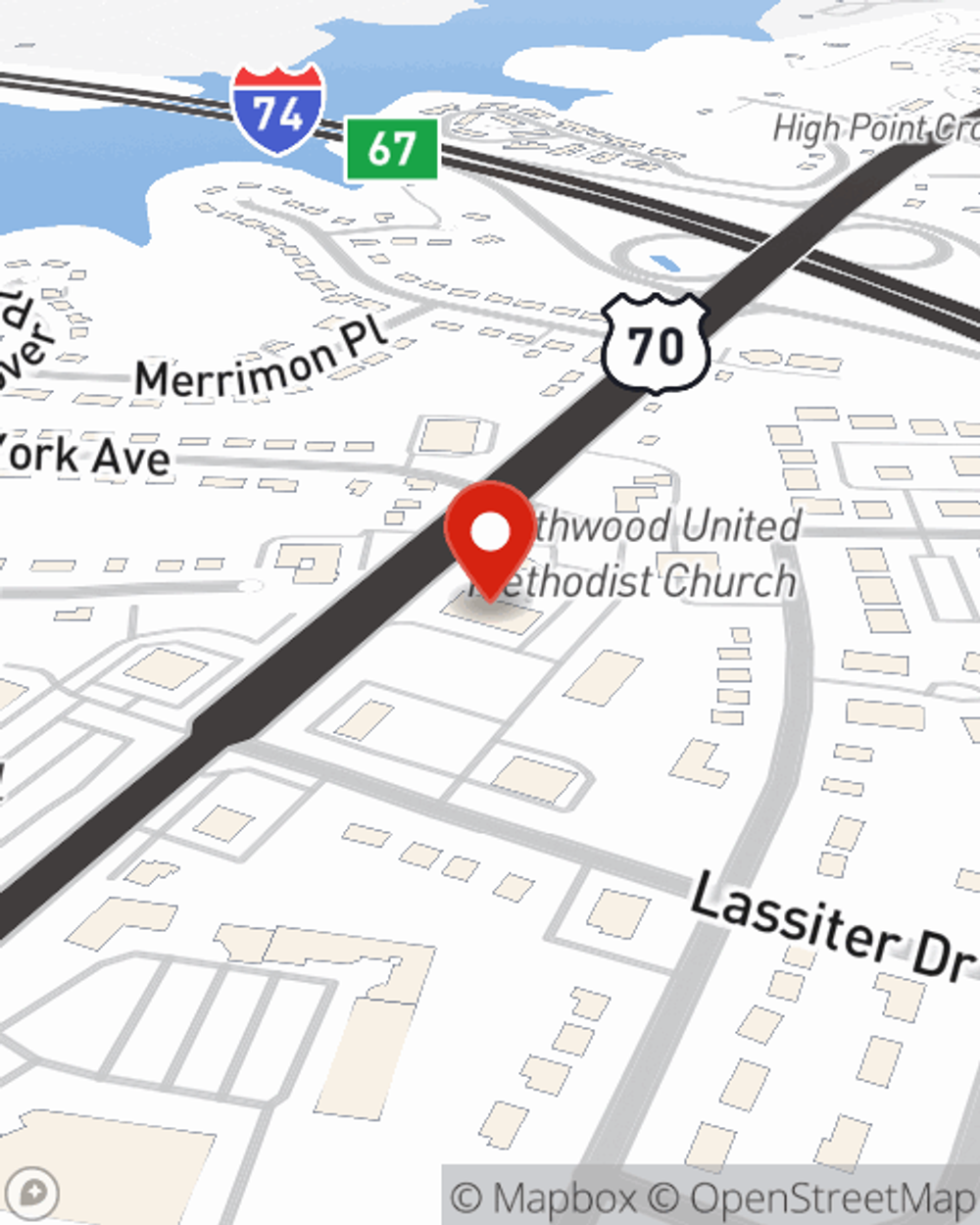

Business Insurance in and around High Point

One of the top small business insurance companies in High Point, and beyond.

Insure your business, intentionally

- High Point

- Winston Salem

- Greensboro

- Jamestown

- Kernersville

- Lewisville

- Clemmons

- Thomasville

Business Insurance At A Great Price!

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Zach Barnes help you learn about great business insurance.

One of the top small business insurance companies in High Point, and beyond.

Insure your business, intentionally

Keep Your Business Secure

Whether you are an HVAC contractor a barber, or you own an appliance store, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent Zach Barnes can help you discover coverage that's right for you and your business. Your business policy can cover things such as business property and accounts receivable.

It's time to reach out to State Farm agent Zach Barnes. You'll quickly observe why State Farm is the reliable name for small business insurance.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Zach Barnes

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.